Chart of the Week

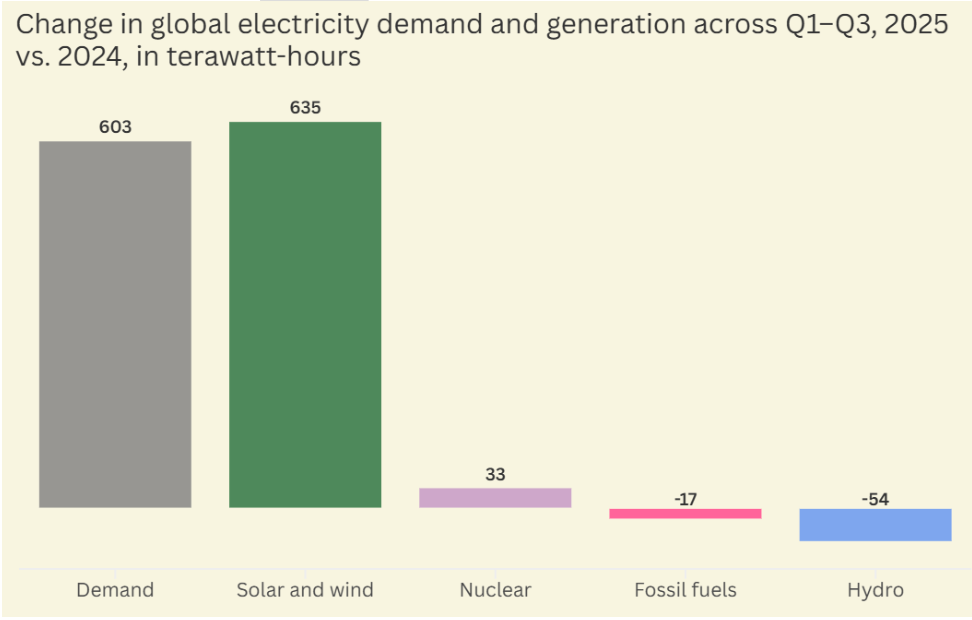

Solar and wind are growing faster than electricity demand.

Global electricity demand between Q1 and Q3 this year increased by 603 terawatt hours compared to the same period in 2024, with solar and wind energy together supplying enough new power—498 terawatt hours from solar and 137 terawatt hours from wind—to meet and exceed that growth. This growing energy demand occurred alongside a 17 terawatt hour decrease in fossil fuel generation, highlighting how renewable energy sources displaced fossil fuels in the global electricity mix this year.[Canary Media]

Energy Transition

Members of the global Utilities for Net Zero Alliance (UNZE) pledged at COP30 to raise annual energy transition investment by 25% to $150 billion annually, putting the alliance on track to mobilize over $1 trillion by 2030. The group, which is co-chaired by the UK and UAE’s national grid operators, will mobilize most of this investment towards deploying battery storage and modernizing grids, alongside increasing renewables capacity to more than three times its 2023 level by 2030. [IRENA]

Atlas Renewable Energy secured $475 million to build the Copiapó hybrid solar and battery project, which will deliver 750 gigawatt hours of clean energy annually to Chile’s Atacama region. The project will supply renewable electricity to major mining industry offtakers, thus helping decarbonize one of Chile’s most energy-intensive sectors. [Yahoo! Finance]

Five New England states launched a $450 million program to install over 500,000 energy-efficient and low-emissions heat pumps, aiming to phase out carbon-intensive, fossil fuel heating systems. Supported by US federal grants, the initiative will drive down heating costs for contractors and consumers, pilot innovative programs for adoption in low-income households, and is expected to prevent 2.5 million metric tons of carbon dioxide emissions by 2030. [Canary Media]

Green Mobility and Sustainable Fuels

The UK launched a $2.5 billion package to accelerate the country’s transition to EVs, including over $1.5 billion in grants to reduce the upfront cost of EVs for drivers. The plan also mobilizes over $200 million in EV charging facilities across the country, supporting the infrastructure needed for the UK government’s ambition to phase out new petrol and diesel cars by 2030. [Reuters]

Abu Dhabi airports contracted US aerospace company BETA Technologies to supply electric chargers and thermal management systems for its first electricvertical take-off and landing (eVTOL) flights. These flights will use electric power to land and take-off vertically, allowing for low-carbon aviation alongside urban air travel, with 10 public vertiports planned across key urban transit locations. [BETA]

The European Commission unveiled plans to triple Europe’s existing high- speed rail network by 2040 through new rail infrastructure and international connections, aiming to reduce emissions through shifting travelers from short-haul flights to sustainable rail. New routes will allow trains to reach speeds of 155 miles per hour, slashing travel times and creating new direct connections, with routes such as Lisbon to Madrid possible in three hours, a reduction of 66% compared to current routes taking up to nine hours. [The Guardian]

Sustainable Materials & Products

The European Commission adopted a new Bioeconomy Strategy targeting $11.6 billion in collective industry purchases of bio-based materials by 2030, aiming to displace fossil-fuel based imports with circular materials. The strategy will create a Bioeconomy Investment Deployment Group to coordinate public and private funding, set new targets for bio-based content in products, and reward farmers and foresters for practices that advance sustainable biomass use across the continent. [European Commission]

Recycling company RetuRO announced the collection of over 7.5 billion units of plastic in the first two-years of its deposit return scheme, a public-private partnership in Romania transforming plastic beverage packaging into recycled raw materials sold to manufacturers. The scheme charges consumers an additional $0.11 per beverage, refundable upon packaging return, and is now the world’s largest fully integrated deposit return system with collection rates of up to 94%. [The Guardian]

Recycling startup Sortera developed an AI-powered system that can sort and separate aluminum grades separate from scrap metal with over 95% accuracy.Sortera secured $45 million to expand its operations from its initial Indiana plant to a second Tennessee facility, where its sorting technology will reduce energy consumption compared to virgin aluminum through converting automotive scrap metal into low-carbon aluminum which can be indefinitely recycled for use in new vehicle manufacturing. [Canary Media]

Notable Corporate Commitments

Crédit Agricole unveiled a sustainable finance target to reach a 90/10 green- brown finance ratio by 2028, matching every euro of fossil fuel finance with nine euros towards low-carbon energy. The bank further committed to facilitating $280 billion in transition finance, supporting hard to abate sectors as they reduce their carbon intensity, by the end of 2028. [ESG Today]

Schneider Electric and British multinational retailer Marks & Spencer (M&S) partnered to launch RE:Spark, a program aiming to decarbonize supply chainsthrough increasing renewable energy usage from M&S suppliers. RE:Spark will facilitate aggregated PPAs, allowing groups of smaller suppliers in Turkey, Bangladesh, Vietnam, India, and China to access renewable energy at more competitive rates than would be otherwise available. [Yahoo! Finance]

Global Climate Commitments and Progress

The European Union and South Africa concluded a year-long initiative to mobilize public and private investment into Africa’s energy transition, securing $17.9 billion in investment pledges from the EU, African Development Bank, and EU member states. The investment is expected to bring a cumulative 26.8 gigawatts of renewable energy capacity to 17.5 million households in Africa currently without reliable electricity access. [European Commission]

The South Korean government announced its Nationally Determined Contribution (NDC) target ahead of COP30, to reduce greenhouse gas emissions by 52-61% from 2018 levels by 2035. This goal signals a ramp up in South Korea’s climate action, targeting a further 20% of reductions compared to the nation’s previous NDC. [The Korea Times]

Multimedia Insights

In light of stalling negotiations towards a global agreement on climate adaptation,Semafor interviewed climate finance leaders on solutions to overcoming bottlenecks in delivering private finance for climate adaptation. Maryanne Hancock, CEO of YAnalytics and Partner at TPG, highlighted recent TPG work towards catalyzing this investment into adaptation solutions.

This installment of the BBC World Service’s Documentary Podcast visits Normandy, France to discuss the implications of coastal erosion for residents and the region’s oyster economy. Through examining local adaptation needs in Normandy, a region losing up to a meter of coastline from erosion annually, this episode provides a glimpse into the debates and discussions shaping adaptation solutions in climate vulnerable regions.

Climate Events

Dates: January 13-15 2026

Location: Abu Dhabi, UAE

Preview: The World Future Energy Summit will bring together 450+ businesses and 300+ speakers for a discussion on innovative solutions towards advancing the energy transition. Based in Abu Dhabi, the summit will highlight increasing renewable spending in the MENA region and pathways to further the energy transition in the UAE.

HackSummit New York Climate x Deep Tech

Dates: December 10-11 2025

Location: New York, USA

Preview: This edition of HackSummit will bring together startup founders, climate tech investors, and speakers for discussions on how to leverage innovation and tech for climate solutions. Panel discussions highlight technological solutions at the forefront of supply chain resilience, climate adaptation, and sustainable food systems.

This material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The views expressed herein are those of the third-party sources and not necessarily those of TPG.