Chart of the Week

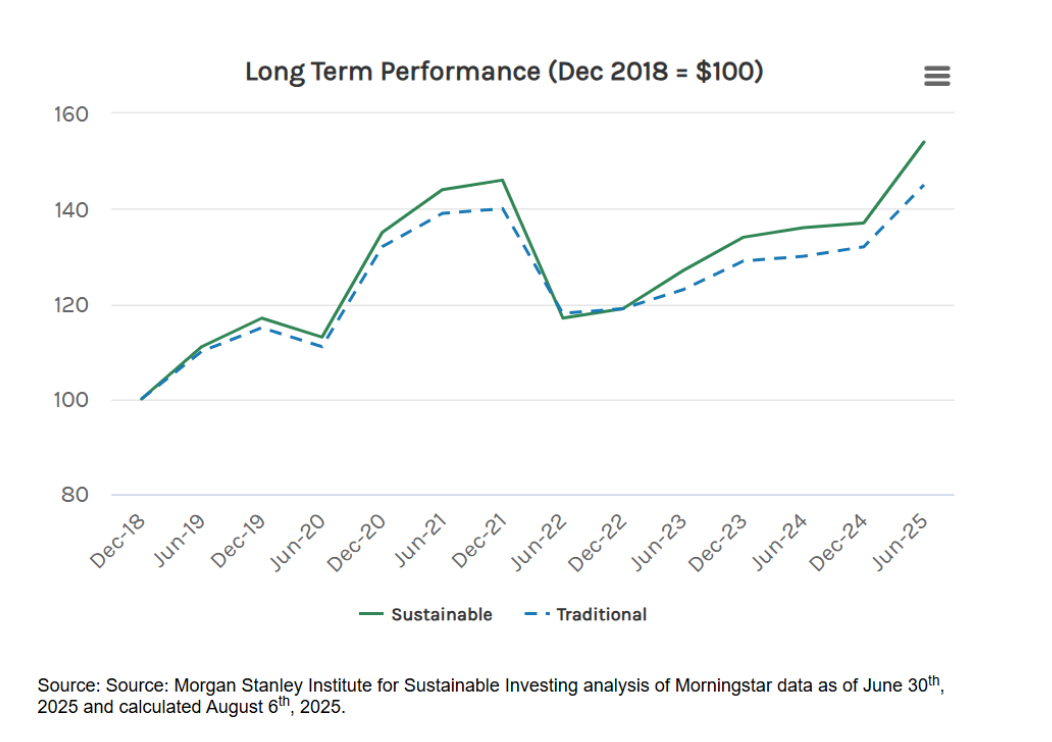

Sustainable Investment Funds Outperform Traditional Funds in First Half of 2025

In the first half of 2025, sustainable funds with binding ESG criteria outperformed traditional funds by 3.3%. The “Sustainable Reality” report highlights that sustainable funds have outperformed traditional counterparts since 2023, with the gap widening to an all-time high in 2025. [Morgan Stanley]

Energy Transition

A trio of Saudi Arabian energy companies invested $8.3 billion in 15 GW of renewable energy projects. The investment continues a trend of solar investment in the Kingdom as it aims to reach 50% clean electricity by 2030 through boosting solar capacity to 100 GW.[WallStreet Journal]

UK gas provider, Centrica, partners with US based X-energy to deliver the UK’s first advanced modular reactors in a $10 billion nuclear power plan. The project’s initial phase will deploy 12 reactors in Northern England, capable of powering 1.5 million homes by the mid-2030s. [Financial Times]

Los Angeles pilots the US’ first onshore wave energy project, a continuously operating renewable power supply aiming to power 60,000 homes annually. The project contributes to LA’s 2035 climate target of 100% clean energy. [LA Times]

Green Mobility and Sustainable Fuels

Australia announced an AU$1.1 billion investment into low-carbon liquid fuels targeted at powering aviation, cargo ships, and trucks. The plan aims to utilize renewable canola oil feedstock to phase out petrol and diesel, positioning the country as a leader in global biofuel supply chains. [AU News]

Porsche’s all-electric Cayenne offers first-of-a-kind wireless charging in 2026 model, enabling drivers to park over an at-home charging pad to refuel the car’s batteries. The system operates at an 11kW charging speed with over 90% efficiency, comparable metrics to current cable EV charging solutions. [USA Today]

200 shipping companies requested the International Maritime Organization (IMO) to adopt a first-ever global fee on shipping greenhouse gas emissions. If implemented following IMO negotiations in October, the fee will become mandatory from 2027 and target large oceangoing ships accounting for 85% of global shipping emissions. [PortNews]

Sustainable Materials & Products

Australia announced an AU$500 million fund delivering grants to early movers in green iron, targeting commercial-scale production by 2031. As the largest global supplier of iron ore, Australia is attempting to decarbonize the steelmaking process which accounts for 8% of global greenhouse gas emissions. [Manufacturer’s Monthly]

The European Parliament passed an extending producer responsibility (EPR) directive in the textile industry, mandating textile producers to retain responsibility for waste management throughout the full product life cycle. The directive will come into effect as early as 2027 and aims to combat the region’s 12.6 million metric tons of annual textile waste. [Wall Street Journal]

A Greenland-based startup receives funding to expand its carbon dioxide removal solution to commercial scale, accelerating the natural carbon cycle using glacial rock dust to facilitate long-term carbon storage. The dust, exported as a nutrient-packed fertilizer, transforms croplands into permanent carbon sinks through reacting with and storing carbon dioxide in an Enhanced Rock Weathering (ERW) process. [Bloomberg]

Notable Corporate Commitments

Patagonia expands its sustainability leadership from apparel to agriculture, with Patagonia Provisions offering low-carbon crackers and beer. The products utilize Kernza, an alternative wheat grain with increased carbon absorption properties. [NY Times]

Clean Harbors, a leading provider of environmental and industrial services, reaches its 2030 recycling target 5 years early, recycling 1.9 million metric tons of materials in 2025. The newly released Sustainability Statement highlighted that the company has abated double its greenhouse gas emissions for 5 consecutive years, eliminating 4 million tons of greenhouse gases in 2024. [Stock Titan]

Global Climate Commitments and Progress

China announced a plan to double its domestic energy storage capacity to 180 GW by 2027, after racing past earlier government targets. The plan aims to stimulate $35 billion in investment for the sector and will mostly be achieved through boosting lithium-ion battery storage. [Reuters]

Zimbabwe published draft legislation establishing a climate fund that supports projects mitigating climate impacts and responding to climate emergencies. The fund will draw its financing from carbon trading proceeds and carbon tax revenue. [Bloomberg]

Multimedia Insights

The BBC World Service Podcast “The Climate Question” highlights the concept of positive climate tipping points- moments at which the switch to a clean energy future becomes unstoppable. This episodeinterviews Tim Lenton, author of “Positive Tipping Points: How to Fix the Climate Crisis” for a discussion of the progress already taking place, and how its likely to gain momentum.

This installment of Climate Risinghighlights Himanshu Gupta, the cofounder and CEO of ClimateAi, a startup using machine learning to forecast extreme weather and boost agricultural climate resilience. ClimateAi is currently used by 25% of the top food and beverage companies to manage their climate risk.

Climate Events

Dates: 10-21 November 2025

Preview: Alongside COP30, the Sustainable Finance Forum will convene banks, insurers, and investors to discuss the deployment of sustainable finance towards a “Just Transition”, nature and biodiversity, and disclosure and sustainability risk management.

Dates: 13-16 October 2025

Preview: The Adaptation Futures Conference will meet in Christchurch, New Zealand to connect policymakers, advocacy groups, and practitioners in a discussion of the future of climate impacts and pathways for adaptation.

This material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The views expressed herein are those of the third-party sources and not necessarily those of TPG.