Chart of the Week

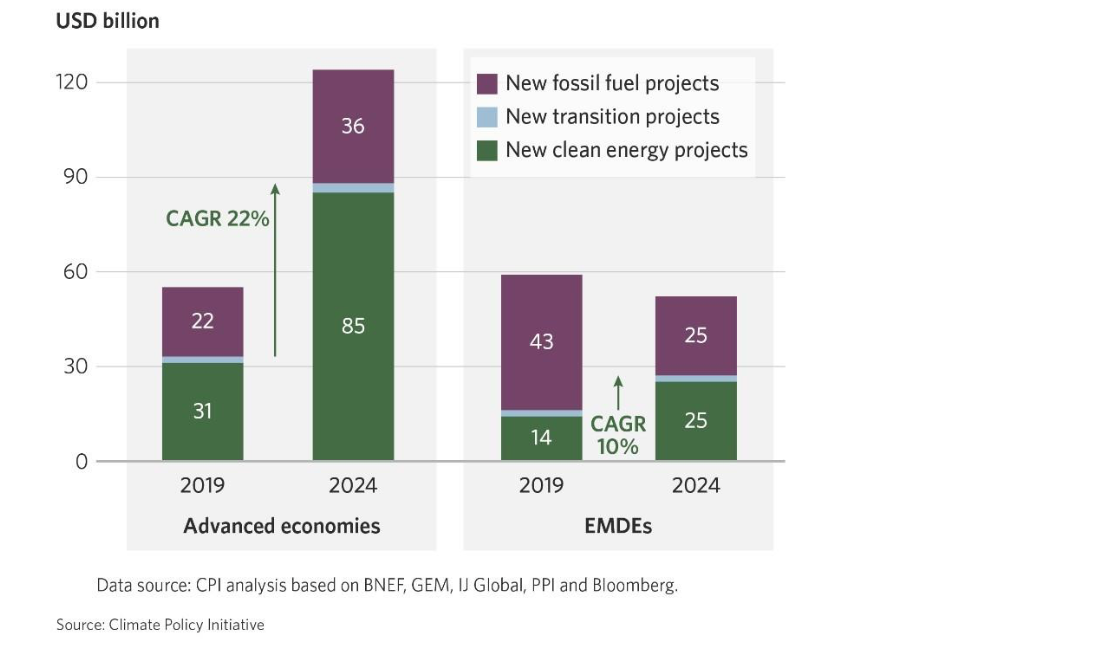

Clean energy and transition projects received the majority of new energy project finance across both advanced and emerging economies.

Direct new project finance for clean energy and transition projects grew more than 2x faster than new fossil fuel investment between 2019-2024, reaching $110 billion globally in 2024. During the same period, project finance for new fossil fuel projects in emerging markets and developing economies (EMDEs) decreased from $43 billion in 2019 to $25 billion in 2024, underscoring a global transition toward sustainable energy solutions and a pivot away from fossil fuels.[Climate Policy Initiative]

Energy Transition

Australia’s Capacity Investment Scheme (CIS) awarded contracts set to deliver a cumulative 6.6 gigawatts of new renewable generation and 11.4 gigawatt hours of battery storage capacity. The CIS, a federal program providing long-term revenue contracts to de-risk energy and storage development, underpins Australia’s strategy to attract large-scale private investment into renewables, with the projects anticipated to spur $11.2 billion in private local investment. [Energy Storage News]

ReNew Power, India’s largest private renewable energy company, secured $331 million in financing from the Asian Development Bank to build a 2.8 gigawatt hybrid solar-wind-BESS project in Andhra Pradesh, India. The project will power over 2 million households once completed and is set to become one of the world’s largest hybrid renewable installations by integrating multiple clean energy sources into a single site. [Business Wire]

Energy storage developer Highview raised $170 million for the construction of its liquid air energy storage (LAES) technology, which uses excess energy to compress air in cryogenic tanks, that can be later heated to power turbines and dispatched as usable electricity. Once fully operational, the site will provide 2.5 gigawatt hours of storage capacity to Scotland, where 40% of wind energy is curtailed due to insufficient grid connectivity between Scotland and the high energy demand area of Southern England. [The Times]

Green Mobility and Sustainable Fuels

The European Commission committed to mobilizing $3.3 billion towards sustainable fuels in maritime and aviation before the end of 2027. This investment will support the technology scale-up required to meet the EU’s maritime and aviation decarbonization targets, which will require 20 million tonnes of alternative fuels by 2035. [European Commission]

Highway operator VINCI Autoroutes piloted the world’s first in-motion wireless charging highway on a 1-mile stretch outside Paris, charging the vehicles at average speeds of 200 kilowatts. Electreon, the company behind the “Charge As You Drive” technology, aims to addresses charging downtime constraints in electrified freight transport. [ESG News]

Rolls-Royce has successfully tested the world’s first high-speed marine engine powered entirely by methanol. This test is part of the meOHmare research project, a partnership with organizations including engine company Woodward L’Orange and the Technical University of Denmark, which aims to accelerate the commercial availability of methanol-powered, CO2-neutral marine engines. [Rolls Royce]

Sustainable Materials & Products

Hybar opened its nearly $1 billion Arkansas steel mill, decarbonizing steel production through its connection to the nation’s largest behind-the-meter solar and battery system. The facility can produce over 700,000 tons of reinforcing bar annually, fulfilling 7% of U.S. demand while dramatically reducing the industry’s environmental footprint. [AEDC]

Battery recycling company Redwood Materials opened its $3.5 billion South Carolina facility, with its recycled critical minerals now being the largest domestic source of cobalt, nickel, and lithium in the US. Redwood’s recycling process allows mined critical minerals to be repurposed indefinitely, reducing carbon emissions by 58% and water consumption by 72% compared to conventional virgin mining. [Bloomberg]

Several of the world’s largest consumer goods companies, including Unilever, Nestlé, PepsiCo, and L’Oréal endorsed the Ellen MacArthur Foundation’s 2030 roadmap for curbing plastic waste in their product life cycles. Since 2018, participating companies avoided 14 million tons of plastic waste, with the updated roadmap focused on scaling existing recycling technology and Extended Producer Responsibility (EPR) legislation across supply chains. [ESGNews]

Notable Corporate Commitments

Chanel, Prada, Moncler, and other leading luxury fashion brands launched the European Accelerator initiative, aiming to decarbonize fashion supply chains. The accelerator functions through three consecutive workstreams— first harmonizing environmental data collection across value chains, then leveraging this data to work directly with suppliers to reduce emissions and finally working to bridge the investment gap required to decarbonize. [Yahoo!Finance]

IKEA and BTG Pactual Timberland Investment Group committed to reforesting and restoring 4,000 hectares of deforested or low-productivity pastureland in Brazil’s Atlantic Forest biome. The project will contribute to IKEA’s existing commitment to investing $100 million towards removing and storing carbon. [ESG News]

Global Climate Commitments and Progress

The Government of Malawi and the Dubai-based Green Economy Partnership launched the world’s first AI-powered Paris Agreement Implementation Platform (PAIP), which securely tracks national emissions, finance mobilization, and carbon trading in real-time. Malawi unveiled the platform at COP30 and hopes it will serve as a scalable model for national-level integration of the Paris Agreement’s compliance and reporting obligations. [Zawya]

Brazil achieved $5.5 billion in national pledges for its Tropical Forests Forever Facility (TFFF), a COP30 investment fund sharing returns with nations based on their protection of tropical forest ecosystems. The fund expects to attract private investment of up to $125 billion, which will specifically target forests in the Democratic Republic of the Congo, Brazil, Colombia, and Indonesia, with 20% of proceeds earmarked for indigenous and local communities. [APNews]

Multimedia Insights

Sustainability media outlet Edie is covering the ongoing international climate negotiations in Belem through its daily podcast, “COP30 Covered”. The first episode outlines key themes for the summit—from climate adaptation finance to promoting nature-based solutions—with subsequent installments unpacking highlights and takeaways from each day of negotiations.

This episode of Harvard Business School’s “Climate Rising” podcast features

Garen Nelson, Chief Climate Officer at the Massachusetts Clean Energy Center (MassCEC). Nelson highlights how MassCEC is working to de-risk climate technology investments through early-stage grants, equity investments, and infrastructure support.

Climate Events

Dates: December 5-7 2025 Location: London, UK

Preview: The Resilient Cities Forum will convene stakeholders to discuss solutions embedding climate resilience into urban design. The conference features panel topics at the intersection of climate, equity, and public health, including building community resilience and integrating environmental data into decision making.

Dates: December 2-3 2025 Location: Toronto, Canada

Preview: This summit will bring together investors, founders, and climate leaders to spotlight climate innovations addressing a range of challenges from food systems to critical minerals. This edition of the summit focuses on showcasing early-stage climate tech ventures and highlighting technologies making climate adaptation investable.

This material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The views expressed herein are those of the third-party sources and not necessarily those of TPG.