Chart of the Week

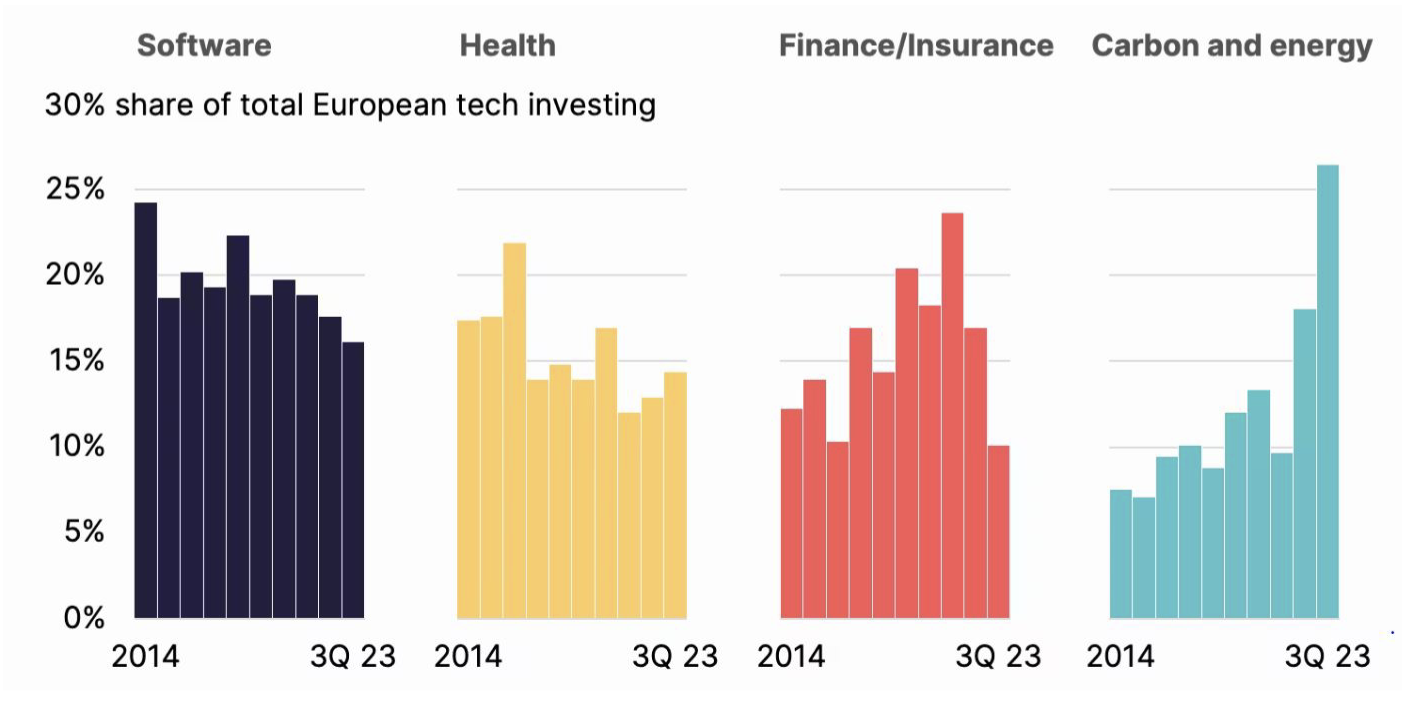

Climate Is Now the Biggest Sector For European Tech Investing

Climate takes the lead from software to become the largest European tech investing sector. The industry has been steadily rising since 2014, contributing over 25 percent of the total European tech investing share by 2024. [Nat Bullard]

Energy Transition

DataVolt announced a $5 billion investment to develop the first net-zero AI data center in NEOM, a region in the northwest of the Kingdom of Saudi Arabia. This facility, set to begin operations by 2028, will be powered entirely by renewable energy, utilize advanced cooling technologies, and support Saudi Arabia's goal to become a regional hub for digital technology and artificial intelligence. [ESG News]

India's state-owned Oil and Natural Gas Corporation (ONGC) and NTPC Green Energy Ltd announced a joint venture to acquire Ayana Renewable Power for $2.3 billion, including debt. Ayana operates 1,600 megawatts of solar and wind power plants in India and has an additional 2,500 megawatts under construction, aligning with India's goal to expand its renewable energy capacity by 500 gigawatts by 2030. [Reuters]

Turkey's clean power plans heavily depend on the successful launch of its nuclear age, with the first unit of the Akkuyu nuclear power plant expected to start production this year. Once fully operational, the Akkuyu plant is anticipated to generate around 10 percent of Turkey's electricity, significantly contributing to the country's clean energy goal to reach net zero emissions by 2053 and reducing its reliance on coal. [Reuters]

Green Mobility

Ceer, Saudi Arabia's first electric vehicle (EV) company, secured $1.5 billion in local partnerships to drive the growth of the EV sector. These 11 new partnerships, over 80 percent of which are with Saudi companies, aim to strengthen the local automotive supply chain and infrastructure, support economic diversification, and create jobs in line with Saudi Arabia's Vision 2030 goals. [ESG News]

Revel, the largest provider of public electric vehicle fast-charging in New York City, received a $60 million public loan from the state of New York to significantly expand its public EV charging network. The loan, provided by NY Green Bank, will enable Revel to add 267 new charging stalls across nine sites, with most expected to be completed within the next 12 months and the remainder by 2027. [Utility Dive]

Ionna, an automaker-led joint venture, announced its commitment to deploying 30,000 electric vehicle charging bays across the United States by 2030. The joint venture, backed by leading automakers like Hyundai, BMW, and General Motors, has already transitioned from its public beta phase to a full-scale national release, with over 1,000 additional charging bays expected to be operational this year. [Automotive Dive]

Sustainable Fuels

Sierra Space successfully completed a test campaign for its hydrogen-powered upper stage engine, the VR35K-A, at a United States Air Force Base in California. This engine, which uses liquid hydrogen and liquid oxygen, is intended to support future National Security Space Launch (NSSL) missions, providing a national security advantage, high performance, reduced complexity, and significant cost savings. [H2 View]

The International Civil Aviation Organization (ICAO), with support from Airbus and Boeing, launched the Finvest Hub, a global platform designed to connect aviation sustainability projects with global investors. This initiative aims to accelerate investments in sustainable aviation fuel (SAF) production, clean energy infrastructure, and other decarbonization projects, with a particular focus on supporting developing nations to achieve net-zero carbon emissions by 2050. [ESG News]

Accelera, Cummins' clean tech arm, plans to supply a 100-megawatt proton exchange membrane (PEM) electrolyser system to BP’s green hydrogen plant in Lingen, Germany.The project, which reached its final investment decision in December, aims to produce up to 11,000 tons of green hydrogen per year for BP’s refining processes and is expected to be fully commissioned by 2027. [H2 View]

Sustainable Materials & Products

Republic Services announced a target of $1 billion for mergers and acquisitions in 2025, following the recent acquisition of Shamrock Environmental, a North Carolina-based company specializing in industrial waste and wastewater treatment services. This move is part of Republic's strategy to expand its environmental solutions and recycling capabilities, with significant investments planned in its fleet and sustainability initiatives. [Waste Dive]

Japan recently announced new policies to incentivize the production and adoption of green steel, which includes a subsidy of 50,000 yen ($330) for clean energy vehicles (CEVs) manufacturers built with low-emission steel. This initiative is part of a broader strategy by Japan's Ministry of Economy, Trade and Industry (METI) to reduce carbon emissions from its steel sector, which relies heavily on coal-based blast furnaces, by encouraging the use of low-emission technologies and materials. [Reuters]

Australia's parliament recently passed a law providing production tax breaks for critical minerals, including cobalt and lithium, and renewable hydrogen to support the country's energy transition plans and aim for net-zero emissions by 2050. The law includes a 10 percent tax incentive for processing and refining 31 critical minerals and offers A$2 per kg for renewable hydrogen production, starting from the fiscal year ending June 2028 to 2040. [Reuters]

Notable Corporate Commitments

Moody's announced that global sustainable bond issuance is projected to reach $1 trillion in 2025. This growth is expected to be driven by substantial investments in climate change mitigation and adaptation projects. [ESG News]

Amazon’s Climate Pledge Fund announced an $83 million investment in Twelve, a company specializing in carbon transformation technology. This funding will support the expansion of Twelve’s operations, particularly the development of their AirPlant One facility, which utilizes Opus technology to convert carbon dioxide into sustainable fuels and materials, contributing to the reduction of global carbon emissions. [ESG News]

Global Climate Commitments and Progress

The Spanish Government announced the selection of 16 projects for its €1.2 billion hydrogen valley program, with major companies like Repsol, Moove, and BP among the beneficiaries. These projects, which include significant electrolyser capacity and pre-contract offtake agreements for green hydrogen output, are part of Spain's efforts to enhance its green hydrogen infrastructure and meet its energy transition goals. [H2 View]

Indonesia announced plans to significantly expand its renewable energy capacity, targeting 17 gigawatts of solar and 16 gigawatts of hydro power over the next decade.This initiative aims to increase the share of renewables in the country's energy mix from 12 percent to approximately 35 percent. [Bloomberg (Subscription)]

Multimedia Insights

A Feb 11th release of Energy Policy Now highlights the significant rise in electricity demand driven by the rapid expansion of AI data centers and reshoring of manufacturing in the United States. The podcast features Rob Gramlich from Grid Strategies discussing the urgent need for solutions to accommodate this increased load on the electric grid, including integrating renewable energy sources and advanced grid management policies.

A Feb 11th release of Interchange Recharged addresses the urgent need to strengthen climate resilience in the United States, emphasizing the importance of balancing climate mitigation with adaptation strategies. Sylvia Leyva Martinez and Nuin-Tara Key discuss how robust frameworks and state-led adaptation strategies, like those in California, are essential for communities and economies to effectively manage and respond to the impacts of climate change.

Climate Events

Dates: March 3 – 4, 2025

Location: Cambridge, Massachusetts

Preview: The MIT Energy Conference is the largest student-led energy and climate event in North America, bringing together industry professionals, investors, academics, and policymakers annually. The conference features keynote speeches, panel discussions, a climate tech startup showcase, networking sessions, and special events to address and explore significant challenges and opportunities in the energy and climate sectors.

Dates: March 19, 2025

Location: Melbourne, Australia

Preview: The 3rd annual Climate Investor Forum will bring together leading decision-makers in climate solution investments and deployments. The forum facilitates commercial interactions and knowledge exchange, featuring nine sector sessions showcasing Australia's innovative and scalable climate solutions.

This material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The views expressed herein are those of the third-party sources and not necessarily those of TPG.