Chart of the Week

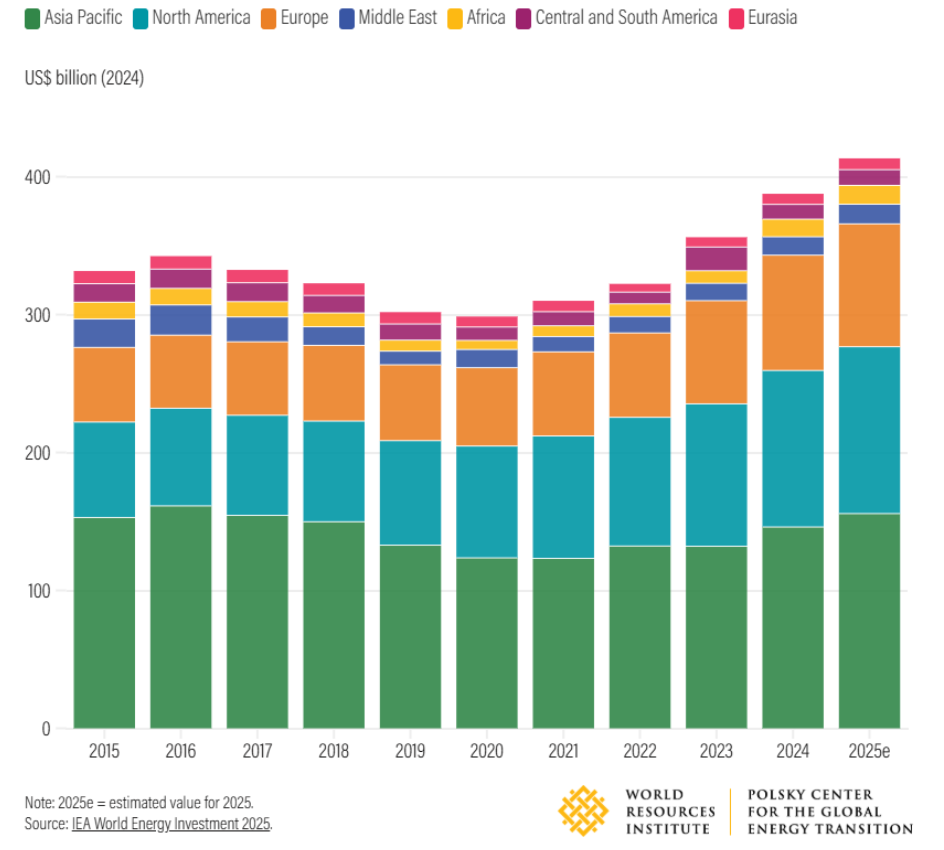

Investment in power grid infrastructure by region.

Investment in the electric grid has increased 7% annually from 2020, with expectations to reach a record $410 billion in 2025. This investment growth, driven by Asia Pacific, North America, and Europe, is crucial for improving system reliability and can support clean energy transitions by upgrading grids to handle increased renewable power supply.[World Resources Institute]

Energy Transition

The European Commission proposed a fivefold increase in funding, from $6 billion to $30 billion, for cross-border energy infrastructure projects aimed at bolstering grid reliability, lowering energy costs, and improving renewable electricity interconnectivity. The proposal also includes legislative changes facilitating renewable development, slashing decade-long permitting waits to a maximum of two years. [Reuters]

ReNew Energy Global announced plans to invest $9.33 billion to expand clean energy operations in the Indian state of Andhra Pradesh. The funding will contribute to hybrid wind-solar, solar-plus-storage projects, and green ammonia production—all while generating a projected 10,000+ local jobs. [Reuters]

Uzbekistan activated its first utility-scale solar and battery facility, which combines 250 megawatts of solar capacity with a 126 gigawatt hour battery storage system designed to provide renewable electricity and grid stability. The project makes progress towards Uzbekistan’s target of 54% renewable electricity and 25 gigawatts of renewable capacity by 2030, positioning the country as a regional leader in the energy transition. [Zawya]

Green Mobility and Sustainable Fuels

UK EV charging company Gridserve launched an ultra-fast ABB charger on its nationwide Electric Highway network, dramatically reducing charging downtime with 400 kW charging speeds adding 100 miles of range in under 10 minutes. The ABB charger continues Gridserve’s rollout of chargers across the Electric Highway, a nationwide program increasing the accessibility of high-speed EV charging with 200 charger locations spanning 85% of the UK highway network. [Gridserve]

Eight EU member states, including France, Germany, and Spain, launched the eSAF Early Movers’ Coalition, which will mobilize at least $580 million in funding for large-scale SAF projects. The coalition will provide producers with revenue certainty through a double-sided auction that bridges gaps between producer costs and market prices, helping to scale production towards the EU’s latest targets, which mandate SAF reaching 1.2% of aviation fuel by 2030 and 35% by 2050. [S&P Global]

Renewable energy company Masdar and waste manager Tadweer partnered to develop Abu Dhabi’s first commercial waste-to-SAF plant, which aims to convert 500,000 tons of waste per year into aviation fuel through a hybrid process. The facility will use waste gasification to turn refuse into syngas and blend it with green hydrogen to create SAF, supporting Tadweer’s ambition to divert 80% of waste from landfills by 2030. [ESG News]

Sustainable Materials & Products

Fortescue and TISCO, a subsidiary of the world’s largest steelmaker China Baowu, partnered to pilot hydrogen-based plasma-enhanced ironmaking, through low-carbon technology that will produce 5,000 tonnes of molten iron annually. The first-of-its-kind technology uses high-energy plasma and hydrogen to convert iron ore into molten iron without coal, reducing emissions by eliminating the carbon-intensive steps of coking and sintering. [Reuters]

Recycling startup Samsara Eco launched the Nylon Materials Collective, a partnership with major outdoor brands including The North Face and Arc’teryx to scale enzyme-based recycling for nylon, of which less than 2% is currently recycled. Participating brands aim to scale nylon recycling by pooling demand and adopting Samsara Eco’s enzyme tech, which breaks down nylon into base components to be reconstructed as high-performance recycled fiber. [Trellis]

Tata Steel received backing for a pilot collaboration with Swedish startup Cemvision to convert slag, a waste byproduct from steel production, into a low-carbon cement feedstock that could replace clinker, an energy-intensive binder used in conventional cement. The initiative is one of several projects supported by a new Indian-Swedish partnership fostering advanced sustainable solutions in heavy industry. [S&P Global]

Notable Corporate Commitments

Deutsche Bank set a $1 trillion target for sustainable and transition finance efforts by 2030, building on $500 billion of sustainable investments made since 2020. The bank’s new sustainability framework also emphasizes the growing role of nature-based solutions in climate finance, aiming to facilitate 300 biodiversity and ecosystem restoration transactions by 2027. [ESG News]

Whole Foods announced the rollout of AI-powered food recycling bins from startup Mill, set to transform food scraps into chicken feed for its own eggs and reduce food waste volumes by up to 80%. Backed by parent company Amazon, an investor in Mill through its Climate Pledge Fund, Whole Foods is targeting the rollout of the technology across stores from 2027. [Axios]

Global Climate Commitments and Progress

Recent analysis from Clean Energy Finance (CEF) highlighted that Chinese firms invested $80 billion in overseas clean technology projects in the last year, bringing total Chinese outbound clean tech investment since 2023 to over $180 billion. This capital is driving the energy transition across emerging markets, with 75% of total capital flowing into projects across Asia, the Middle East, Africa, and Latin America. [US News]

The EU allocated $5.6 billion of revenues from its Emissions Trading System (ETS) to the EU Innovation Fund, which will use the funds to back early-stage climate tech supporting net-zero industry, clean hydrogen, and decarbonized industrial heat. As one of the world’s largest climate tech investors, theFund’s previous awards total over $16 billion across 275 EU projects. [European Commission]

Multimedia Insights

This installment of Harvard Business School’s Climate Rising podcast highlights the work of the JSW Group in ambitiously decarbonizing operations alongside meeting rising Indian steel demand. The Group’s Chief Sustainability Officer Prabodha Acharya and Managing Director Parth Jindal discuss sustainability efforts across hydrogen, carbon capture, and increasing green investment.

This episode of Energy Gang discusses how California’s electricity grid is tackling rising electricity demand from AI, physical damage from wildfires, and a large-scale shift to renewable energy sources. The conversation highlights how California’s grid challenges and solutions could serve as a playbook for other states and countries overcoming infrastructure obstacles in their energy transitions.

Climate Events

Dates: January 19-22 2026

Location: Orlando, Florida, USA

Preview: The Clean Fuels Conference connects key players in clean fuels across land, sea, and sky for exhibits, showcases, and expert sessions spanning biodiesel, renewable diesel, and sustainable aviation fuel.

Dates: January 26-28 2026

Location: San Diego, California, USA

Preview: The Cleantech Forum will bring together investors, innovators, and industry leaders to explore technology solutions driving decarbonization and sustainability. The event offers opportunities for networking, deal-making, and insights into the latest trends shaping the future of clean technology.

Thank you for reading the Rise Climate Insight Digest. We will be on a brief holiday hiatus until January 29th 2026.

This material is solely for informational purposes and shall not constitute an offer to sell or the solicitation to buy securities. The views expressed herein are those of the third-party sources and not necessarily those of TPG.