The current pandemic has introduced disruptions to the movement of people and goods and has exposed how vulnerable global supply chains are to these disruptions.

While shortages of medical equipment such as ventilators and test kits are well documented, there have also been significant challenges in ensuring the supply of the accompanying medical items that are critical for patient care. From the drugs required for ventilator use and fever reduction, to the protective gear needed for health personnel in the testing and care of patients, the fragility in the supply chain for these essential items have become more apparent over the recent weeks.

Concentration of production, increased trade restrictions, and obstacles to ramping up production have led to more intense vulnerabilities in some critical supply chains. This research brief highlights how these factors have led to challenges in ensuring the supplies of medicines, medical supplies, and protective equipment.

Concentration of production

As COVID-19 has expanded its toll across the globe, manufacturers, governments, and experts are increasingly concerned about the resulting “supply shocks” to the value chains of critical medical goods, given their production is particularly concentrated in a handful of countries. That concern is not without merit: trade data shows how production of key medical goods is concentrated in only a few countries, mainly in Asia: China leads the manufacturing of key protective equipment, producing nearly 50% of protective eye wear and 30% of protective face masks, while Malaysia1 and Thailand together produce 67% of the world’s surgical gloves. (Exhibit 1)

In addition, while trade data on the various components of medicines are hard to trace2, some sources highlight that around 80% of active pharmaceutical ingredients (APIs) used in generic drugs manufactured in the US are produced in China and India. For example, 70% of acetaminophen, used for fever reduction and pain relief, is reported to come from China. Sedatives such a fentanyl and propofol, which are administered to patients placed on ventilators to help them breathe, are also made with core ingredients from China and India. In contrast, medical supplies such as laboratory or diagnostic reagents are mostly produced by the United States (26%) and European countries (55%), with much of production in Germany, the UK, France, the Netherlands, and Switzerland.

While the high degree of concentration is a concern for various developed countries struggling with domestic shortages, the situation can be even more dire for developing nations in Africa and Latin America. As multiple sources have reported, countries from Brazil to Zambia have had to elevate the negotiations with manufacturers of items such as chemical reagents (a key item required to perform for COVID-19 tests) to top levels of government; anecdotal evidence includes country leaders personally calling manufacturing chief executives and offering to send private jets to transport medical supplies, often with limited success.

Increased trade restrictions

As noted in previous newsletters, countries are now seeking to enact more stringent trade restrictions in an effort to ensure sufficient domestic supply to meet the needs of patients and physicians. This has upended trade flows and impacted specifically countries that are more reliant on imports than others.

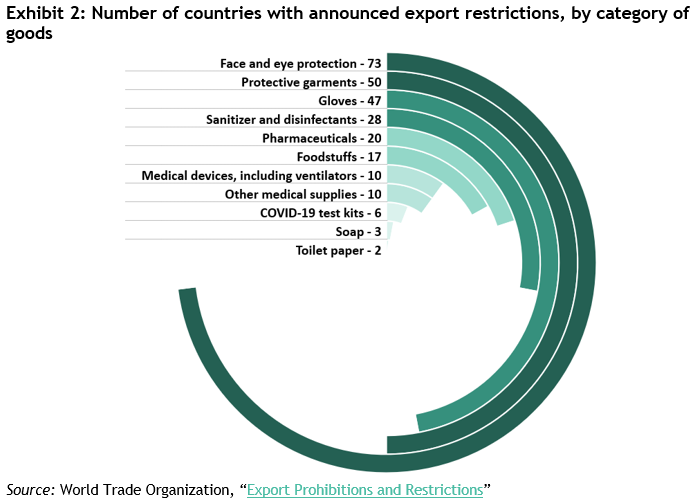

The WTO estimates that at least 80 countries and separate customs territories have thus far introduced export prohibitions as a result of the COVID-19 pandemic. While these bans are generally against WTO agreements, some carve-outs and exceptions are currently being used to justify these extreme measures. (Exhibit 2)

While the largest producers of each category have not yet imposed restrictions on their exports, many other small producers have (for example, Malaysia and Thailand have both announced restrictions on exports of face masks). As a result, the rest of the world has become even more reliant on top producing nations than before.

In addition to export restrictions, there is also indication that supply chains are hampered by tariffs that could make trade more expensive. Recent data compiled by the WTO finds that at least 40% of medical supplies, equipment, and protective gear exports are now subject to tariffs that may restrict the flow of these goods. (Exhibit 3)

Surging demand; obstacles to ramping up production

The American Hospital Association estimates that hospitals treating COVID-19 require up to nine times the protective equipment they do when dealing with the seasonal flu. In addition, countries and regions are now instituting requirements for shoppers and workers to wear face masks while out. These actions have led to near ubiquitous demand for face masks, which historically have only been worn by a few in specialized contexts.

The production of surgical masks, which are relatively easier to make and have fewer barriers to entry, have seen the entrance of new companies and repurposing of existing facilities. One factory in Kenya repurposed its workers and sewing machines from stitching gardening clothes to producing 30,000 surgical masks a day. Companies from luxury brands like LVMH to automotive manufacturers like Zettl Automotive have repurposed their factories to produce surgical face masks. Other companies with facilities less suited for repurposing, like Hershey, have invested significant sums to the production of new facilities to churn out surgical masks. Labs across the world are also exploring the use of 3D printing to mass produce these items.

The production of filtration masks like N95s, which can filter airborne particles, require more complex technology and materials to create, and thus has been more challenging to ramp up. 3M, the largest producer of these masks, activated its surge capacity beginning in January to ramp up production, and in two months have doubled its output to 100 million masks per month. Another complication with filtration masks is that its materials degrade with time, rendering many useless after expiration. Spiez Lab, a Swiss company that provides protective equipment to the Swiss government, repurposed its facilities to inspect expired filtration masks for viability of use to increase the overall stock of protective gear.

For medication and medical supplies, the obstacles to ramping up production are felt even more keenly. In the US, demand for antibiotics has nearly tripled within a month. Similarly, common sedatives and anesthetics have seen increases in orders of up to 100%. Qiagen, a major European supplier of RNA test reagents is now being asked to scale its production from 1.5 million tests per month to 6.5 million, and up to 20 million by the end of the year. Novel COVID-19 vaccines are also placing increasing pressure on unexpected upstream players. These include producers of glass vials, who have seen exacerbated levels of glass shortage, and oil producers that extract from trees like the Quillaja Saponaria Molina, in order to produce adjuvant – a substance to help strengthen the body’s immune response to vaccines. These trees, common to Peru, Chile and Bolivia, can only be harvested from November to January.

Biomedical companies have invested in expanded production of potential COVID-19 therapies even before they are clinically approved. Gilead, the company responsible for a new therapy recently shown to reduce time to recovery, made strides in as early as January to build supply chains capable of delivering 1 million courses of treatment by the end of the year (up from 140,000 today). Similar approaches are seen in vaccine manufacturing, where donors have been investing to start the manufacturing process at facilities in Britain and the Netherlands before the vaccine being developed is proven to work.

Increasing supply chain resilience and improving disaster planning

The coronavirus pandemic has unearthed supply chain vulnerabilities that were previously known but not prioritized, while at the same time introducing a new layer of complexity: disaster planning for pandemics.

As many experts have noted, companies who sell finished goods generally know production and shipment schedules for their closest suppliers, but they usually have little to no knowledge of suppliers further up the chain. This vulnerability has proven costly to many companies and governments in the current crisis. Governments and the private sector took note: in an effort to improve this, the US congress gave new powers to the FDA to identify where drugs and ingredients are manufactured, which will bring more visibility to the supply chain. Not surprisingly, the crisis has also increased organizations’ focus on incorporating higher levels of uncertainty into disaster planning and more broadly, on improving resiliency to these types of future shocks.

Footnotes

- Other sources like Bloomberg estimate Malaysia’s share to be 65% once you take into account narrower product categories within “rubber gloves”

- Only New Zealand requires legal provisions for drug marketers to disclose their supply chain sources

- Trade is aggregated at the HS-6-digit code, which may include more items than what is medically used

- Rubber surgical gloves: 401511

- Face masks: 392690, 630790 and 902000

- Protective spectacles and visors: 900490

- Lab reagents: 382200

- HS codes for the different categories were taken from WTO’s report: Trade in Medical Goods in the Context of Tackling COVID-19

Sources

Center for Infectious Disease Research and Policy, University of Minnesota

World Trade Organization (2020)

World Trade Organization (2020)

MIT Observatory of Economic Complexity

Y Analytics aggregates credible findings from leading institutions and researchers. Our goal is to shine a light on the facts made available by content experts and present the implications of these facts. If you have recommendations for additional reputable data sources, insights to help us refine our analysis, or suggested research topics, please contact us at info@yanalytics.org.