As countries navigate their respective positions on the COVID-19 curve and weigh the costs and benefits of lockdowns in their respective contexts, there have been ongoing debates on when and how to reopen, and the effects that reopening will have on different economic sectors.

Some experts have suggested that the best approach for reopening is a sequential opening of sectors, as long as minimum epidemiological standards are met. In the US, some states like New York have followed this approach, while others like Texas have opted to open many sectors simultaneously (including malls, restaurants, retail stores, etc.). Regardless of the specific approach to reopening, the effect on the different sectors will vary—which has impacts on the likely recovery of local and national economies that depend on these sectors.

This research brief focuses on a subset of sectors, including manufacturing, real estate, tourism and agriculture, which together represent ~28% of US GDP. It then discusses some of the experiences of economic reopening outside of the US.

Sectoral impacts of COVID-19 and reopening in the US

Manufacturing

Many states have either reopened the manufacturing sector or are soon to reopen it, given the sector’s importance for the economy (11% of US GDP), the possibility of enforcing social distancing among workers especially in subsectors that are less labor intensive, and the ability not to compromise customer safety relative to other sectors that require more intensive in-person customer interactions. Since many of the jobs in manufacturing are on-site and cannot be carried out remotely, reopening will have an important impact on the sector’s ability to function. Despite this, some experts argue that the crisis may result in bankruptcy for some manufacturers as declining demand, production and revenues, along with debt obligations take their cumulative toll.

Of special interest is the car manufacturing industry; globally, it is the fastest declining industry by revenue growth in 2020. In the US, sales are also sharply decreasing, with sales of light trucks and motor vehicles decreasing by over 40% year-on-year by April 2020. However, US automakers claim to be better prepared to deal with crises: major automakers like Ford and Fiat are not talking about bankruptcy or needed assistance, claiming ‘lessons learnt’ from the 2008 crisis leading to an improved balance sheet and cashflow management. Also, some experts are hopeful about demand projections, as sales have been improving over the last couple of weeks.

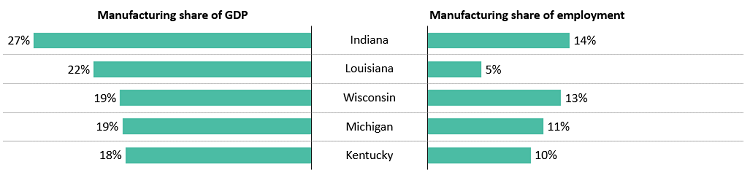

Michigan is an interesting case study because of its historic dependence and association with the manufacturing sector. Not surprisingly, the governor prioritized reopening the sector, while the stay-at-home order was only lifted on June 1. Manufacturing is a critical component of the state economy, comprising 19% of Michigan’s gross domestic product and employing 11% of the state’s workforce (Exhibit 1). Nearly a third of Michigan’s workers filed for unemployment benefits during the last weeks, leading to a total of 1.3 million claims. The largest share of filings came from people working in the manufacturing sector, with 37% of all manufacturing employees seeking unemployment benefits. The reopening of the sector in May is hoped to bring back thousands of jobs that will pull people out of the state’s strained unemployment insurance system. Over the past few months, 37% of employees in manufacturing industries in the state have filed for unemployment and six types of manufacturing industries laid off more than 40% of its workforce according to the W.E. Upjohn Institute for Employment Research, including three industries closely related to automakers (namely plastics and rubber, fabricated metals and transportation equipment), with some facilities permanently closing. The speed of bounce back for these industries will be heavily dependent on the extent to which consumer demand recovers quickly.

Exhibit 1. Manufacturing contribution to GDP and employment 2019, by state

Source: Y Analytics’ calculations using data from the Bureau of Economic Analysis

Real estate and leasing

The sector’s contribution to the overall economy is higher than manufacturing (13%), and was deemed as essential and as part of the “critical infrastructure” designation by the Department of Homeland Security. However, some states initially classified it as non-critical and took longer to reactivate the sector. Some experts have expressed concerns that big malls are going to default on loans, and credit agencies like Moody’s are beginning to put deals “on watch” for how exposed they are to the real estate market.

The fate of big malls and the retail sector is inevitably intertwined. Big malls host a number of major retailers, whose situation has been worsening since before local governments issued shelter at home orders. It is estimated that three quarters of the retailers tracked by S&P had their debt ranked as junk status before the pandemic. The future seems similarly grim: ~100,000 stores are expected to close over the next five years—more than triple the number that shuttered during the previous recession—at a rate of 2% per year until 2025. While retail trade weighs much less in the national GDP (5.5%) than real estate and leasing, its contribution to employment is key, accounting for ~10% of all non-farm workers.

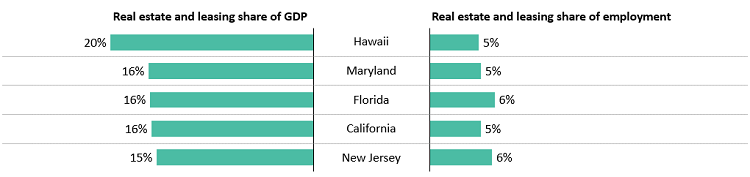

In terms of the housing market, an analysis looking at the share of homes that owe more than their value and the percentage of local wages required to pay for major costs of home ownership, predict that the north east (particularly New Jersey) and Florida are most likely to be the hardest hit by the crisis. This is not surprising, considering that the sector contributes to 16% of Florida’s GDP and 15% of New Jersey’s (Exhibit 2). In the Baltimore region—where the real estate market slowed dramatically in April and the number of homes sold fell to a five-year low—recent data published by Bright MLS shows that local homebuyers have laid claim to much of the available housing inventory, a phenomenon that experts and real estate professionals hope is a sign that the market will rebound quickly, once Maryland reopens further.

Exhibit 2. Real estate and leasing contribution to GDP and employment 2019, by state

Source: Y Analytics’ calculations using data from the Bureau of Economic Analysis

Tourism

Businesses in the travel and tourism industries face the dual impacts of higher transmission risks – which means they are likely to stay closed longer than other sectors – and a dramatic decrease in consumer demand due to economic recessions at home and abroad. As a result, economies that are reliant on these sectors are likely to encounter more challenges during the recovery process.

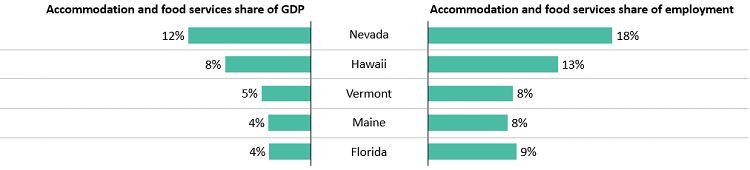

According to some sources, the states expected to be the most affected are Nevada and Hawaii, which have by far the highest share of tourism in their economies. About 12% of Nevada’s GDP is associated with tourism1, with Hawaii at about 8% (Exhibit 3). Hawaii is already projecting a $300 million hit to tax collections and a loss of 6,000 jobs in the service industry because of a decline in visitors. Additionally, Las Vegas Mayor Carolyn Goodman told the area’s convention authority board at its monthly meeting that publicity about coronavirus had had a devastating effect on the city’s economy given the lower influx of visitors for tourism, business and entertainment.

Other states that rank high in terms of their dependence on tourism are Vermont, Maine and Florida (Exhibit 3). Florida made the news recently after it backed off on some of its coronavirus advisory plans to isolate individuals travelling from abroad, amidst concerns of the further damage to the tourism industry. In April, the state’s sales tax collections were estimated to be nearly $600 million behind projections, much of it because of the downturn in tourism and other hospitality-related industries.

Exhibit 3. Accommodation and food services contribution to GDP and employment 2019, by state

Source: Y Analytics’ calculations using data from the Bureau of Economic Analysis

Agriculture

For US farmers the past few years have been challenging: a trade war with China, a growing debt crunch, and extreme weather changes due to climate change. The coronavirus complicated that picture even further as stay-at-home orders pushed restaurant demand downwards for nearly every agricultural product while low oil prices reduced demand for ethanol, hurting corn planters. Cotton producers are also particularly affected as discretionary consumer spending dried up, reducing the demand for cotton clothes.

Prices for crops this year are expected to drop by as much as 10% and prices of livestock by as much as 12% as a result of the coronavirus pandemic. Similarly the demand for red meat, poultry, soybeans, corn wheat and cotton is predicted to sink, and reports of farmers halting crop harvests and dumping milk have emerged.

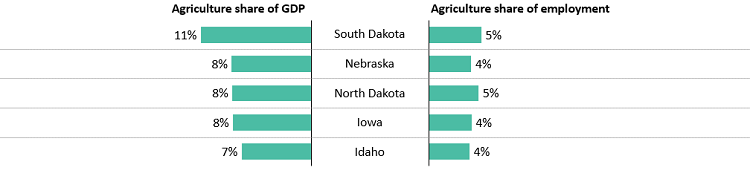

This is specially felt in big agricultural states like North and South Dakota, Nebraska and Iowa, where agriculture represents 8 to 11% of GDP, and where key crops like corn (the most produced crop in the US) are mainly produced. Additionally, farmers in such states are particularly vulnerable to the pandemic, as rural communities have less access to healthcare facilities and personnel, while at the same time being more at-risk due to its significantly older average population – the average age of an American farmer is 57.5 years, compared to 38 years for the average American.

Exhibit 4. Agriculture contribution to GDP and employment 2019, by state

Source: Y Analytics’ calculations using data from the Bureau of Economic Analysis

While each of the sectors mentioned present economic challenges and opportunities in their own right, the holistic economic effects of the pandemic and reopening policies should be considered in the aggregate. An example of the overall economic impacts is seen in California, which stands out both in terms of scale and diversification of its economy. On its own, California is estimated to be the fifth largest economy in the world (after the US, China, Japan, and Germany), and accounts for more than 11% of America’s workers. The magnitude of the state’s economy means that the absolute economic impact that has hit the state as a result of COVID-19 is also large – according to data from the Bureau of Labor Statistics, more than 2.5 million non-agricultural jobs were lost in California alone from February to April of this year, and greater losses are expected as May employment figures are reported. Similarly, the diversity of California’s economy – which, unlike other states, is as diverse as the country’s – has led to impacts being felt in multiple areas of economic activity and across a broad swathe of the population. The closing of businesses and loss of jobs across industries and sectors highlights the importance of a holistic reopening program that allows for a swift, if not complete, economic recovery.

Experiences of reopening outside the U.S.

Looking outside the US, experiences from countries around the world that have reopened their economies may provide indications of how different sectors may fare. In China, where the first cases of the pandemic were reported back in January, government officials assessed business activities based on transmission risks to evaluate which sectors to open, phased over two months. In late February, businesses considered low-to-medium transmission risk, such as manufacturing, construction, and retail, were permitted to restart. By the end of March, 99% of large businesses were open, and in April, even businesses seen to have high transmission risk, including restaurants, hotels, and education institutions, were allowed to reopen.

The economic effects of reopening in China have been uneven across sectors. The manufacturing sector seems to have seen a quicker rebound, with China’s official manufacturing purchasing managers’ index (PMI)—which measures the prevailing direction of economic trends—rising from 35.7 in February to 52.0 in March, surpassing analyst predictions between 45.0 – 51.5, signaling optimism for economic expansion (readings above 50 indicate expansion, while those below 50 signal contraction). Given manufacturing accounts for nearly 30 percent of the economy (whereas the equivalent percentage is much lower in OECD countries such as France and the UK), the speed of recovery of this sector will be an important driver for China’s overall economic prospects. Service activities – which require large groups of people to come together in acts of production and consumption – are not surprisingly facing a slower recovery trajectory. The Caixin/Markit services PMI, which focuses on smaller, private firms, only rose slightly to 44.4 in April (up from 43.0 in March). This was much worse than analysts’ expectations, suggesting that the sector has remained in contraction post reopening.

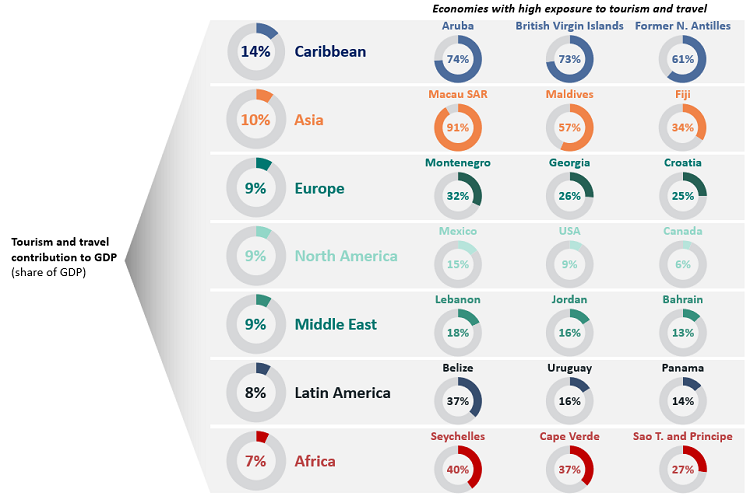

In other sectors like tourism and travel, where restrictions are likely to persist for several months, businesses and employees face a prolonged period without income. According to the World Travel and Tourism Council (WTTC), travel and tourism contributed 10.3% of global GDP, but as seen in Exhibit 5, that percentage can be much higher in certain regions of the world. In the Caribbean, where travel and tourism contribute to 14% of local economic productivity, business owners and furloughed employees are anxiously monitoring both local regulations that have restricted commercial aircrafts from traveling to and from islands, as well as American consumer sentiment, which drives more than half of their yearly incomes. In Macau, where travel and tourism contribute an astounding 91% of GDP (higher than any other economy listed in WTTC’s data), the city’s chief executive announced that the economy would be in a deficit for the first time since 1999. To combat the loss of income for individuals, the government has announced a stimulus package worth 12% of its GDP, which includes shopping vouchers and waived expenses.

Exhibit 5: Global economic exposure to tourism and travel

Source: World Travel and Tourism Council

Looking Forward

A silver lining that has emerged as economies have begun to reopen is the many examples of innovations that have enabled healthier, safer, and more sustainable economic activity. In the retail sector, businesses like Walmart have invested in technology that improves mobile app performance (leading to a 460% increase in downloads since January) and infrastructure that repurposes shuttered storefronts into warehouses for online delivery. Other retailers have licensed Amazon’s cashier-less technology to help stores reopen without risks of inadequate social distancing. To combat the loss of physical visitors, museums, opera houses, zoos, and national parks alike have offered high quality interactive and virtual experiences to engage with the public. In real estate, experts are advocating against traditional 10-year commercial leases, and instead for more experimentation in new formats, such as profit-sharing leases that improve young business’ resilience during times of crisis like these. Among manufacturing, unexpected trends have emerged, such as bolstered sales for electric cars driven by a greater appreciation for clean air. These examples, and many more, point to the resiliency of private businesses during times of crises and the potential for economic recovery when harnessed in partnership with effective policy.

Footnotes:

- Proxying hospitality and tourism with accommodation and food for comparability with other sectors

Sources:

World Travel and Tourism Council

Y Analytics aggregates credible findings from leading institutions and researchers. Our goal is to shine a light on the facts made available by content experts and present the implications of these facts. If you have recommendations for additional reputable data sources, insights to help us refine our analysis, or suggested research topics, please contact us at info@yanalytics.org.