Better Decision-Making, Better Outcomes

Greg Fischer, Former Chief Economist, Y Analytics

Across the world, enterprises and investors are seeing the bigger picture. The resurgence of stakeholder capitalism recognizes that the purpose of corporations extends far beyond maximizing financial returns. Driven by a confluence of company values, customer demands, and employee concerns, corporate leaders are beginning to coalesce around the challenge of improving impact decision making and outcomes. Business can and should play a role in solving pressing social and environmental problems.

A wide range of actors have taken up the challenge, from impact investors seeking to generate positive impacts alongside financial returns, to firms that have moved corporate social responsibility from weekend volunteerism to the core of their operations. Together, they want to target social and environmental impacts with the same rigor, discipline and sophistication that they currently use to estimate, manage and improve financial returns. They want to allocate their resources in a way that is consistent with their values and generates meaningful, lasting impacts. They want to make better decisions today for the benefit of tomorrow.

But while managers and investors can rely on an accepted set of tools to inform decisions where the sole objective is financial returns, the comparable tools for impact are novel and relatively unfamiliar. They need not be.

Targeting social and environmental impacts with the same rigor and discipline requires focusing on two points. First, harness research-based evidence and hard data to inform and quantify the impact of investment and management decisions. Second, employ a pragmatic, operational approach that embeds this evidence in everyday decision making.

The approach we describe works for self-defined impact investors assessing a business where social and financial returns go hand in hand or supporting a portfolio company that wants to enhance its impact. It is equally applicable to every enterprise weighing hard, real decisions such as worker safety and employment stability in a Covid operating environment, supply chain costs and resilience, or financing GHG emissions reductions. The common theme is that when it comes managing impact, neither ignorance nor indifference are viable options any longer. We have pragmatic, science-based tools to make better decisions right now.

Harnessing Evidence is Critical

Decisions affecting people and the planet are too important to be based on intuition and goodwill alone. While the best business leaders have an intuitive sense of what “works” to drive financial value, they support their intuition with hard data and rigorous quantitative analysis. The need for rigor is at least as important for environmental and social impact decision-making, where business leaders generally have less experience on which to rely.

Fortunately, we can tap a large and rapidly growing body of evidence from climate scientists to social scientists to provide this needed rigor. Over the past two decades, policymakers, foundations and nonprofits have increasingly drawn on research to guide their decisions. An evidence industry—led by organizations like the Abdul Latif Jameel Poverty Action Lab (J-PAL), Innovations for Poverty Action (IPA), the World Resource Institute (WRI), and others—has developed to improve both the science and the use of science for improving outcomes, particularly for the purpose of policymaking.

Extending the bridge between this evidence community and the corporate and investor communities represents a massive opportunity. This is true not just for self-defined impact investors but for any capital allocator or corporate decision maker who wants to better understand and improve its social and environmental impacts.

The opportunity is enormous. As of 2024, global impact investing assets under management have grown to over $1.571 trillion.1 This pool of capital, informed by evidence about its potential and ongoing impacts, could literally change the world.

Pragmatism Translates Evidence into Action

Evidence is great. But to have an impact, evidence must be translated into action. Decision tools and impact insights must be intuitive and readily incorporated into a firm’s or investor’s decision processes. This requires a purpose-built approach that is practical, operational, and moves at the cadence of business.

In simplest terms, making good decisions about impact requires answering two questions. First, “Is this business making the world a better place?” The measure of this is net enterprise impact: the total impact of an enterprise, positive or negative, relative to what would have been achieved without it. We will dive into the details later, but for now think of net enterprise impact as the impact analog to net income or EBITDA.

Second, we ask, “Are we using our resources effectively?” To answer this, we compute the impact analogs to traditional business metrics. These include impact returns on equity and assets as well as impact margins and growth rates.

We have seen that translating the answers to these questions into monetary terms and financial analogs helps integrate impact considerations into the core of investment and management decisions. For example, while we may determine that modernizing an older logistics network can reduce CO2 emissions by 200,000 tons per year, it can be much more practically useful to convert this to a monetary value of $20 million per year. Not only does this provide a way to compare and aggregate different types of impacts, it allows an organization to leverage the tools of operations management, capital budgeting and modern portfolio theory to make better decisions about impact.3

The Impact Underwriting Process

In the remainder of this paper, we describe the specific approach that we have taken at Y Analytics4 to assess impact and help organizations like the Rise Fund make better decisions to improve social and environmental outcomes. Along the way we highlight some of the lessons we have learned in evaluating over 300 projects and potential investments. Our experience shows that it is possible to not only increase the rigor and confidence of decisions about impact but to do so at the pace of investment and corporate decision making.

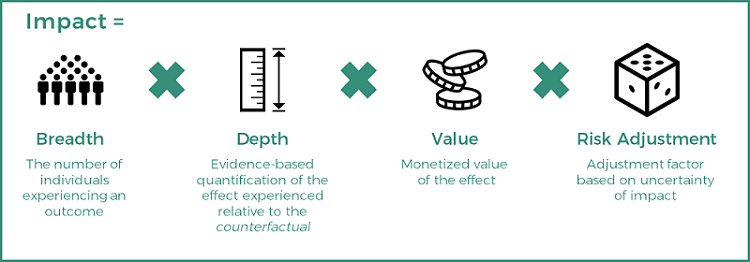

We start by defining impact:

The following equation captures this simply:

I = ntva

where I denotes total impact, n the number of units impacted, t the research-based estimate of impact per unit, v the monetized value placed on this impact, and a the adjustment factor based on the uncertainty in both t and v.

This describes a single impact pathway, for example, the impact a piece of educational software has by improving the math ability of third graders. This will equal the number of children taught (breadth) times the average effect per child measured in the natural units of the outcome such as improvement in test scores (depth) times the monetized value placed on this outcome (value) with an adjustment factor for the risks to impact.

Of course, most enterprises will generate impact along multiple pathways. Just as financial measures can be aggregated across businesses or product lines, monetized impact can be aggregated across pathways. In the educational software example, this might mean aggregating across grade levels, subjects, or geographies.

To determine a project or enterprise’s total impact, we calculate this equation for all the material pathways, both positive and negative, and then add them up. The impact equation provides a useful organizing framework and helps ensure that our assessment principles are consistently applied. As we describe the seven steps in our impact assessment process, we will link each step back to this equation.

Before we proceed, a quick caveat is in order. Seeing an equation naturally raises hopes of mathematical precision. However, the impact equation on its own does little. In the same way that our confidence in financial forecasts rests on sound evidence, sensible assumptions and careful reasoning, it is how we arrive at each component within the impact equation that matters. Following, are the steps to doing just that.

Step 1: Tell the Impact Story

After the discussion of evidence and rigor, it may seem odd to start with an impact story, but all impact decisions begin with the question “How will the life of a single person be different because of something we do?” Will a farmer be able to sell more milk, more reliably, at a higher price? Will someone receive medical supplies that would otherwise be unavailable? How will my supply chain realignment affect job quality and opportunities.

This line of inquiry extends to macroenvironmental impacts. The carbon we emit ultimately affects the health and wellbeing of every individual on our planet, and the waste we produce affects biodiversity and the health of our oceans. We ask, for example, what effect will a restoration program have on a particular acre of land? The stories themselves are compelling—and a reminder of why we all do what we do—but they are also of practical importance: they engage everyone in thinking about how a project or enterprise is impacting people and the planet. This sets the stage for Step 2.

Step 2: Identify Impact Pathways

The next step is to clearly identify the material impact pathways. Identification of impact pathways, which is common in cost-benefit analyses, is most reliably done by tracing significant activities of an enterprise and determining the consequences for stakeholders.

These pathways tend to flow naturally from the impact story. For example, a school might reasonably be expected to improve its students’ learning, and a hospital its patients’ health. But here we move from the free-flowing narrative to precise qualification. How does the school improve learning? Does it improve math scores, time spent reading, or non-cognitive skills? Are benefits targeted at a particular age group or at-risk population? Every pathway will have its own breadth, depth, value, and risk of impact.

Additionally, it is essential to consider both positive and negative pathways in order to build an accurate picture of net impact. A rural electrification project may provide employment opportunities and quality of life improvements but also increase carbon emissions. Commercialization of agriculture can increase farmers’ incomes and provide higher quality nutrition while also increasing plastic waste from packaging. Accounting for positive and negative pathways can reveal opportunities to better manage impact. If, for example, we identify plastic waste as a significant negative impact, an enterprise can prioritize recycling or develop alternative packaging. Improving impact can be as much about reducing negatives as increasing positives.

We can confidently rely on companies themselves to identify positive pathways. Accurate and credible impact measurement requires equal attention be afforded to potential negatives. We therefore support this process through neutral assessment as well as engagement with researchers and subject matter experts.

Linking back to the core equation, steps 1 and 2 tell us which pathways we need to assess to get an accurate measure of a company’s impact. Each pathway gets its own equation. The next four steps describe how we evaluate each of these.

Step 3: Assess Breadth of Impact (n)

Once an impact pathway is identified, information on consumers, suppliers, employees and other stakeholders can be used to estimate the breadth of impact along that pathway, n. For example, Dodla Dairy is a company that sources milk from small holder farmers. One impact pathway for Dodla Dairy is removing uncertainty for farmers by guaranteeing offtake. In this case, n would represent the number of farmers given purchase guarantees. We base our breadth calculations on company reports or managers’ and investment professionals’ projections, as comparable transparency about assumptions is key to credibility. Managers are already accountable for these assumptions.

Step 4: Synthesize Evidence for Depth of Impact (t)

The next step is to quantify the depth of impact (t) per unit of breadth. For example, in an educational technology company, t may be the average increase in math scores achieved by students using the product. For Dodla, it may be the increase in farmers’ income. How should one quantify these impacts?

Harness evidence. This is the crux of our methodology. Intuition and good intentions need to be supported by hard data and careful quantitative analysis.

For an illustration of how intuition can sometimes fail us, consider microcredit. It lends itself to compelling impact narratives: some people who were once extremely poor took out microcredit loans, and now they are no longer poor. It is easy to tell a story that microloans were responsible for their exit from poverty. It would be tempting to invest based on this story alone. But in places we have studied closely, from Morocco to India and Mongolia to Mexico, the evidence we have suggests the average effect of microcredit is small at best.5

At this point, one might be concerned that turning to evidence provides yet another reason to say “no” to an investment or capital decision. But that is not the case. Remember: our goal is to direct resources efficiently and effectively towards addressing some of the world’s toughest challenges. A focused and substantial improvement of a negative impact may in fact be the most impactful action that should be taken.

With that in mind, let’s return to the example of microcredit. While microcredit seems to do little on average, digging deeper into the data shows a significant positive effect for a particular type of borrower. For those who already have a small business and are keen to grow, access to a microloan is often transformative. This information refines our original narrative and enables better decisions. In areas where financial access is limited, we should not extend microcredit indiscriminately. Rather, we should target loans at those who are likely to use them productively and explore alternative solutions for others.

One might also be concerned that the bar for evidence is set too high. We are not saying that impact must be valued exclusively through rigorous, academic, randomized control trials (RCTs). There are many forms of evidence. In some cases, evidence from an RCT may be available and conclusive. For example, in the case of DreamBox, a provider of K-8 educational software, the company had already enlisted independent organizations to conduct two RCTs that quantified the impact of the company’s products on student learning outcomes before the Rise Fund considered its investment. These provided an ideal starting point for quantifying impact.

But this is a special case. Despite increasing attention to valuing impact, it is still rare for an opportunity to come bundled with a rigorous evaluation of the exact product or service in the exact population. In the absence of such ‘perfect research’, we still draw on rigorous, third-party evidence. For example, Cellulant’s AgriKore platform offers mobile banking services to farmers in Nigeria. Consider one impact pathway, the provision of a mobile savings product to previously unbanked individuals. There was no evidence of impact for this exact product. However, Dupas and Robinson’s (2013) study of a savings product for self-employed individuals in rural Kenya estimated that access to a savings account increased food consumption 13% by protecting against income shocks and allowing individuals to better smooth consumption across a year. While not identical, the settings and products were sufficiently similar that this measure could serve as a starting point for underwriting. Applying evidence from related but not identical contexts requires special care and adjustments for uncertainty. We will return to this topic in Step 6 below.

In other cases, the impact of a project or enterprise may hinge on quantities best measured, at least in part, by the enterprise itself. For example, for a stove proven by efficacy trials to reduce indoor air pollution and thereby improve health outcomes, a key determinant of impact may be the share of customers who are using the product. Here we can combine the evidence from an existing efficacy trial (that is, the product’s impact under ideal circumstances) with data on actual usage to estimate realized impacts.

Finally, there are situations where the impact opportunity outstrips the evidence. For example, what is the impact of better battery storage, an innovative cancer therapy, or a new bus network in a particular city? Here again, a clear-eyed view of the evidence still matters.

First, we need to distinguish between the absence of evidence and evidence of absence. For example, it means something very different to say, “We have evidence that the effect of air filters on school attendance is zero” than to say, “We have no evidence that air filters affect school attendance.” When we are in the latter situation, we return to Step 2—identifying the potential impact pathways—and ask what would need to be true for this pathway to have a material impact. We use such questions first to frame a sense check—is it plausible that such conditions could hold?—then to identify opportunities for active measurement. For example, if the potential impact of a company hinges on the income distribution of its customers, we may commission a rapid survey to determine this distribution and then work with the enterprise to collect the necessary impact KPIs to track this on an ongoing basis.

Alternative Worlds: The Counterfactual

With this understanding of how we harness evidence for impact, let’s dig deeper into precisely what we mean by impact. The impact of an enterprise is the difference between the relevant outcomes that actually occur and what those outcomes would have been if the enterprise did not exist. This alterative world—what would have happened without the enterprise—is called the counterfactual. Though this term is standard within the social sciences and the impact assessment community, it is more of a novelty for managers and investors. However, the idea is one that resonates with anyone who cares about social and environmental impact. The aim is to compare the outcome of interest for those of a “treatment” group that had access to a company’s products or services to those of a “control” group that is similar in all respects but for the fact that they did not.

At the most basic level, consider the outcomes of a single individual reached by a company’s products; for example, the income of a student who received training in software development from DigitalHouse, an education provider throughout Latin America. We ask ourselves, “What would this person’s income have been if DigitalHouse did not exist?”

We compare the outcomes for students who attended to the counterfactual, what would have happened to them if DigitalHouse did not exist. The difference between the outcomes of the attendees and the counterfactual is the impact of DigitalHouse.

Of course, we never get to see the alternative reality. A growing group of researchers from academia, NGOs, the private sector, governments, aid agencies and international financial institutions specialize in credibly quantifying this counterfactual and, in doing so, accurately assessing impact. We draw on this body of work in order to assess the likely impact of an enterprise before the first dollar is invested and throughout the life of the project.

How Do We Select Research?

By some counts, the research community generates over two million unique pieces of research per year. Of course, only a very small share of those are both valid and relevant to assess a particular pathway. How do we choose?

When we first began our work, the process was necessarily reactive and bespoke. In response to new projects, we would sift through various research databases and evidence clearing houses, review relevant studies, and select a single “anchor study” to quantify the likely effects. We would also seek guidance from subject matter experts in order to help us evaluate large bodies of evidence, direct us to hard-to-find research, and fill in knowledge gaps where necessary.

Experience is continually improving and streamlining this process. Given the unique scale of our work, we have built and are continuously expanding a database of deals, research and expert knowledge: Y DataTM. We still reach out to subject matter experts, not just for impact insights in novel areas but also to stay on the frontier of evidence. Leveraging these experts, our experience and Y DataTM, we are able to continually improve the accuracy and speed of our analysis.

This combined platform allows us to synthesize evidence from multiple sources and avoid the dangers of a single anchor point. When evidence is limited, we may rely on a single source describing a comparable but not identical setting. As described in Step 6 below, we reflect the inherent uncertainty of this research in our calculations. When evidence is available from multiple sources, we knit them together to construct a more robust measure. The risk of picking a single anchor study is that another thoughtful analyst could go through the same exercise, with the same considerations, anchor on a different study and arrive a very different conclusion. An informed perspective on all the available research and data—including both its quality and relevance—helps prevent this potential incongruence. We employ practical tools that make the best use of the available evidence and are working with leading econometricians and statisticians to further evolve our approach.

Step 5: Monetize Impact (v)

The next step is translating these outcomes into dollar terms. While small, single issue organizations often stop at specific, locally relevant measures (e.g., the change in vaccination rates caused by mobile vaccination camps), monetizing impact is essential for enterprise-level decision-making, which requires aggregation across multiple activities and can include both positive and negative impacts. Moreover, monetization plugs naturally into a businesses’ decision-making machinery. For more about how and why this works, see our January 2020 Impact Learning Series note: Monetizing Impact.

So how do we do it? Here again, we ground our decisions in third-party research and evidence, where available. In the case of a renewable energy provider, for instance, their key impact may be reducing CO2 equivalent emissions by one million tons per year. How do we value this? We turn to the research and analysis of experts in this field, such as Pindyck (2019), the Carbon Disclosure Project, the Energy Policy Institute at the University of Chicago and others. Synthesizing the available evidence, we arrive at a baseline social cost of carbon of $100 per ton of CO2 equivalent. Thus, the value of emissions reductions produced by this renewables company would be $100 million per year (1 million tons × $100/ton).

Critics claim that monetization is essentially subjective. Absolutely. Monetization is subjective. But so is any approach to making decisions about complex social and environmental issues. The danger comes from conflating objective measures (e.g., a careful evaluation shows this program increases graduation rates by 10 percentage points) and the subjective valuations of these impacts (e.g., we value each additional student graduating at $25,000). Different stakeholders may well value outcomes differently. Monetization makes these differences transparent and provides a medium for decision-making, comparability and accountability.

These values need not be exact. If, for example, your decision would be the same whether you value carbon at $50 per ton or $120, you do not need to decide on a precise value. And what if the cutoff point sits within an enterprise’s range of values? Finance and management professionals are accustomed to dealing with risk. Monetization makes it possible to incorporate impact risks directly into their decisions.

Valuing outcomes for which there is no market—e.g., reduced inequality or cleaner oceans—is challenging. Does an extra dollar of income have greater impact for someone living on $5 per day than $50? Benchmark values for health outcomes and mortality risk vary dramatically by country, but should health or human lives be valued differently just because of an accident of geography? How should we value biodiversity? Again, we rely on research and outside experts to provide a basis for these decisions. They must reflect both the decision-makers’ values and a nuanced understanding of the issues. For example, purchasing power parity adjustments reflect, as best as possible, the value of goods and services that an increase in income can buy in a particular location.

While acknowledging the limitations of monetization, it is important to remember that the primary goal of any strategy for impact-oriented management—be it for impact investing or enterprises seeking to improve their impact performance—is to make better decisions for social and environmental outcomes. This will involve making hard tradeoffs. Should we invest in a company that provides hospital care in sub-Saharan Africa or one that builds solar arrays in India? Support EdTech for secondary schools or early childhood education? Spend $15,000,000 per year to switch to post-consumer recycled packaging? These decisions all involve value judgments. Monetizing impacts enables transparent and constructive dialogues around the inevitable tradeoffs.

Step 6: Reflect Risk and Uncertainty (a)

Just as risk affects financial returns, so too does it affect impact. It is here that a, the risk adjustment factor, comes into play. We use a to adjust expectations of impact for different kinds of risks, including, but not limited to, the risk of business output, the risk of product usage, and the risk of research suitability. Research risk requires particular nuance as it is manifest only in the impact assessment and not the financial assessment of a deal. In an ideal situation, we would have exact information on the effect of the product in consideration. However, this is rarely the case, which makes relying on even the most suitable research inherently uncertain. The research risk itself breaks down into many components—risk of scaling, risk from change in geographies, risk of change in product design, etc.—which we factor into our calculations.

While the importance of these factors varies subtly across contexts, our focus is pragmatism. We therefore use a risk adjustment rubric that allows us to rapidly convert specific factors—from research quality to the potential for usage drop-off—into a, the adjustment factor.

As we move up the experience curve and observe the outcomes of choices made, we continue to refine the rubric. With information flowing through a feedback loop, it is possible to improve the predictive power of those weights and even tailor them for different contexts. The more deals evaluated, the more accurate these predictors can become.

Step 7: Calculate Metrics that Enable Better Decisions

The preceding six steps produce a risk-adjusted estimate of the monetary value of impact for each impact pathway. The final step brings this all together, with the aim of building impact tools that are intuitive and can be readily incorporated into a firm’s or investor’s decision process.

We consider three types of impact metrics:

- Net enterprise impact, which answers the question “To what extent is this business making the world a better place?”;

- Efficiency metrics, which quantify how effectively an organization is utilizing its resources to generate impact; and

- Tailored decision tools, which adapt to the needs of a particular enterprise or asset class.

Net Enterprise Impact. First, we add up the value of all impact pathways, both positive and negative, to calculate net enterprise impact. This is the core building block of understanding impact. It captures the total impact of an enterprise, positive or negative, relative to what would have been achieved without it. Just like its financial analogs, net income or EBITDA, it provides an easily understood snapshot of what an enterprise produces.

We envision a world in which enterprises report this value alongside their usual financial metrics. Like financial metrics, net enterprise impact can be tracked over any decision-relevant unit of time that is supported by an organization’s impact KPIs. This includes quarterly impact reports—so management can be as aware and responsive to impact trends as it is to movements in revenue—growth rates, five-year aggregates, and even the capitalized value of future impact, because the decisions we make affect not only today but the legacy we leave for the next generation.

Aggregating net enterprise impact across all operating units can be used to produce an Impact P&L, which mirrors a traditional P&L, quantifying the net value of a company’s environmental and social impacts. We work with managers and investors to align impact KPIs with verified impact pathways and to ensure that the understanding of these pathways is based on the evidence frontier. Again, our focus is on pragmatism, so these measures must all feed into useful decision tools, like heatmaps of impact performance across operating units or impact margins as a percentage of revenue across major product lines.

Efficiency Metrics. As with financial metrics, we can scale annual net enterprise impact into widely applicable and comparable measures of efficiency, or impact yield TM. Our primary measure of impact yield is net annual enterprise impact divided by total equity value. It is the impact analog to return on equity.

Other efficiency metrics, such as impact margins, impact return on assets, and growth rates, provide further perspective on how effectively an enterprise is utilizing its resources and where it can do better. These metrics also provide comparability and allow for benchmarking by industry, sector and geography.

Tailored Decision Tools. Finally, we can calculate additional impact metrics that are tailored to specific investment and management decisions. Because our goal is to support better decisions about impact, it is essential that we understand how decision-makers evaluate opportunities and what they want to accomplish.

Growth private equity investors like The Rise Fund often measure financial performance using the multiple of money. This is the ratio of money returned to money invested. So, for private equity investments we calculate an impact analog, the impact multiple of money (IMM). The IMM begins with projected enterprise impact over the investment holding period, typically five years. To this we add the projected increase in impact capacity, which values investments and exits that create long-term impact potential. We then adjust this total for the ownership stake and divide by the size of the investment. For example, if The Rise Fund invested $100 million for 60% of a business that was projected to generate $1 billion of total impact, the IMM would be 6x. This means the enterprise is projected to generate $6 of positive social and environmental impact for every dollar of equity invested. For corporates, impact return on assets (IROA) or impact margins may fit more naturally into their decision-making frameworks.

Taken together, these three sets of metrics contribute to an impact management system that enables dynamic comparison and decision-making across an enterprise. Holistic impact management begins with integrating impact metrics into core business decision tools and extends to utilizing Y DataTM visualization tools, including enterprise impact reporting and management scorecards.

Whatever their specific use, all these metrics serve a common purpose: to help businesses and investors make better decisions about impact and, in doing so, allocate more resources more effectively for the benefit of people and the planet.

Rigor at the Pace of Business

This type of rigorous, decision-relevant impact assessment does not take years or even months. With the right capabilities and assets it can be conducted efficiently. We routinely perform such assessments within a few weeks, aligning with the normal timelines of financial assessments for major capital or operational allocation decisions or investment due diligence. The key advantages that enable this pace are (1) curated research that allows for rapid identification of material pathways and the most relevant evidence and (2) the skills to translate research into analytical insights. Efficiency and effectiveness grows with access to learnings across an at-scale number of assessments.

Conclusion

Our vision remains simple: enable investors, entrepreneurs and corporate leaders to target social and environmental impacts with the same rigor, discipline and sophistication that they currently use to estimate, manage and improve financial returns. This begins with rigorous evidence and thoughtful analysis to identify and quantify impact pathways, both positive and negative. Monetization translates these impacts into a common language for decision-making. Converting evidence into impact metrics and decision tools that move at the pace of leading capital allocators puts impact at the center of business. Pragmatism is key.

Done well, this enables corporations and investors to make better decisions every day. Done together, it can direct trillions of dollars of capital for the good of people and the planet.

We would like to thank Paddy Carter, Dean Karlan, and Jeremy Nichols for helpful comments and constructive conversations.

Disclaimer: For informational purposes only; not intended as investment advice

1 Global Impact Investing Network, “Sizing the Impact Investing Market.”

2 S&P Global Corporate Capex Survey 2019.

3 See Step 5 and our January 2020 Impact Learning Series note Monetizing Impact for a deeper look.

4 Y Analytics began as part of the Rise Fund with the aim of helping allocate large amounts of private capital efficiently and effectively towards addressing global challenges such as those highlighted in the United Nations’ Sustainable Development Goals. The tools, which we continue to refine, are designed to be applied anywhere understanding the value of an environmental or social impact would enable better decision-making: from planning major capital expenditures, to setting impact strategy, to investment due diligence.

5 Banerjee, Karlan and Zinman (2015) “Six Randomized Evaluations of Microcredit: Introduction and Further Steps” and Meager (2019) “Understanding the Average Impact of Microcredit Expansions: A Bayesian Hierarchical Analysis of Seven Randomized Experiments”.